The 2024 work incentive schedule has been released. What’s noteworthy is that the work incentive payments have increased since this year, and after the deadline, applications have also been raised. Can I get work incentives, too? How much can I get if I do? If you’re curious, please read this!

How long is the 2024 work incentive application?

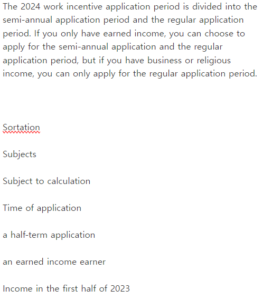

The 2024 work incentive application period is divided into the semi-annual application period and the regular application period. If you only have earned income, you can choose to apply for the semi-annual application and the regular application period, but if you have business or religious income, you can only apply for the regular application period.

Sortation

Subjects

Subject to calculation

Time of application

a half-term application

an earned income earner

Income in the first half of 2023

2023.9.1~9.15

Income from the second half of 2023

2024.3.1~3.15

a regular application

Income of workers, businesses, and religious persons

Annual Income for 2023

2024.5.1~5.31

Earned income earners who applied for the first half of 2023 in September last year may have already received the first half of the work incentive. If you applied for the first half of the year, the second half of the year will also be automatically recognized, so you don’t need to do it separately in March. The date of the work incentive payment for the second half of the year is in June, and the exact date has not yet been released.

On the other hand, the regular application period is from May 1st to 31st, and if all income earners, including earned income, businesses, and religious people, meet the application requirements, they can apply. The payment date is around the end of August to early September.

If you couldn’t apply for the work incentive during the regular application period, you can apply after the deadline. The application period after the deadline is from June 1st to November 30th, 24. However, if you apply for the work incentive through the report after the deadline, you will receive 95% of the work incentive, not the full amount. Previously, applicants for work incentives through the report after the deadline could only receive 90% of the payment, but this year, they can receive 95% of the amount, up 5%.

But the best way is to apply for it in time for the 2024 work incentive application period and receive 100% of it, right?

What will be the terms of the work incentives?

The work incentive is literally a system to encourage work. So it’s targeting low-income workers who work but have a hard time making a living due to low income, small self-employed people, etc. At this time, the work incentive conditions have to meet two things. One is based on income and the other is based on property.

1) an income standard

Income is classified into single households, single-income households, and dual-income households based on the total income of each household.

Sortation

single furniture

single-income furniture

a double-income household

gross income-based amount

Less than 22 million won

Less than 32 million won

less than 38 million won

※Based on furniture classification ※

① single furniture

It refers to a single-person household with a spouse and dependent children, and no direct ancestor over the age of 70.

② single-income furniture

It refers to a household with a spouse’s total salary, etc., less than 3 million won, dependent children, or lineal ascendant aged 70 or older. At this time, the amount of income for each dependent child and lineal ascendant must be less than 1 million won per year.

③ a double-income household

The total salary of each applicant and spouse is more than 3 million won. Single-income households must be less than 22 million won, single-income households must be less than 32 million won, and dual-income households must be less than 38 million won to receive incentives.

2) property standards

In addition to the income standards seen earlier, the property standards must be met. As of June 1, 2023, incentives are only available when the total amount of property owned by all household members is less than 240 million won.

At this time, real estate, jeonse, automobiles, deposits, and savings are included in the property, and just because there is a debt, it is not deducted from the total amount of the property.

🚨 Note! People like this don’t get work incentives!

Even if the above two requirements are met, the following people are excluded from the work incentive.

If you are not a Korean national as of December 31, 2023

If you are a dependent child of another resident during 2023

Where an applicant (including a spouse) is engaged in a professional business

Work incentives, how much can I get?

If you meet the conditions for receiving work incentives, the most curious thing is, ‘So how much can I get?’ The amount of work incentives is calculated differently depending on the applicant’s household type, income, and property amount. First of all, the maximum amount of work incentives available according to household type is as follows.

Sortation

single furniture

single-income furniture

a double-income household

gross income-based amount

Less than 22 million won

Less than 32 million won

less than 38 million won

the maximum amount paid

1.65 million won

2.85 million won

3.3 million won

As you can see from the table, the payment amount is not a fixed amount, but the word ‘maximum’. For example, even in the range of less than 22 million won based on gross income, work incentives are paid differently depending on the level of salary. It’s a little complicated, but if you want to know the specific amount of support, please use the formula below.